News

Analysis: Water Bills Being Used To Pay Down Company Debts

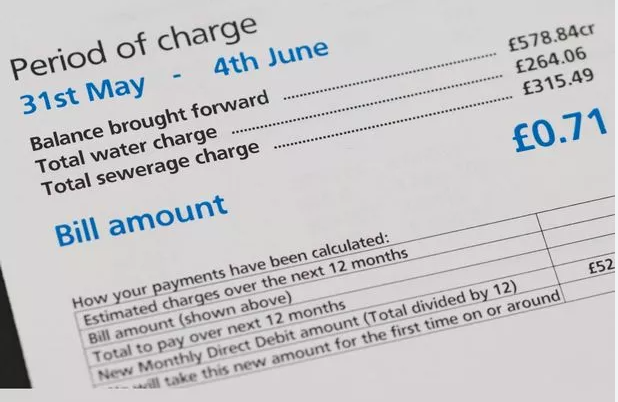

A new investigation carried out by the Guardian and Soas University of London has found that more than 25 per cent of water bills in London and some parts of southern England have been used to pay interest on debts accrued by privatised water companies, with the industry paying almost 20p per pound of revenue on servicing debt over the last five years.

All in all, privatised water firms around England have amassed a debt pile totalling £60.3 billion, apparently in order to fund essential infrastructure to help keep the taps running. However, a close look at their accounts suggests that this money may have gone elsewhere, with £53 billion paid out in dividends to shareholders between 1990 and 2023.

Analysis by the news source, alongside Dr Kate Bayliss of the university’s department of economics, found that all 14 water companies in England were using revenue to service their debts, but customers in the south-east are being hit particularly hard by soaring costs associated with interest and fees relating to what is owed.

Thames Water, South East Water and Southern Water, for example, all use over a quarter of the revenue from water bills to meet the cost of their debts.

And, of course, Thames Water recently hit the headlines for running into financial difficulties, amassing debts of nearly £15 billion… and now warnings have been issued to its parent company that the company may well run out of cash by April next year if more money isn’t found.

What is interesting to note is that the publicly owned Scottish Water only spent only ten per cent of its revenue on its debts this year, which suggests part of the problem may be down to privatisation of public services.

And, in fact, English water companies were all free from debt when they were privatised back in 1989, with the aim being to stimulate investment without having to put pressure on the taxpayer or borrow from the government.

As such, it’s perhaps little wonder that concerns are being raised about the fact that the water industry is now looking to Ofwat for permission to raise bills even more in order to cover the £96 billion investment required to tackle water leakage rates in England, as well as driving down sewage overflow discharges and the construction of new reservoirs.

Dr Bayliss explained that a lot of the debt these companies have built up took place when interest rates and inflation were low, but times have changed and – as she says – the risks associated with this financial strategy are now “coming home to roost with an increasing share of revenue, which is almost all from customer bills”.

She went on to note: “Companies are now seeking to increase bills, but a significant share of price increases could be directed to paying the costs of old debts rather than financing new investment.”

The case the water companies make is that they took on this level of debt to invest in service provision, but experts say that the debt has been used instead to pay out significant returns for shareholders.

Ofwat is yet to approve the water firm’s business plans that include the proposed bill increase of £156 a year by 2030… but a decision is expected to land this month (December), so watch this space!